As my business partner, Grant, mentioned in his post discussing how to calculate closing costs, our goal as hard money lenders is 100% transparency for our clients. In order to provide that level of clarity, it’s important that they understand not only what fees we charge, but also why we charge them and how we calculate them.

So, in this blog post I’m going to explain exactly how to calculate interest payments on your hard money loan.

After reading this post, you will walk away with an in-depth understanding of how to calculate and manage interest payments on your hard money loan so you can accurately forecast the cost of borrowing money for your real estate investments.

If you haven’t already, I recommend you read my first post in this series where I discuss the basics of this topic before diving into the specific details below.

Components of Your Interest Payment

In addition to the three components we discussed in Part I (Loan Amount, Annual Interest Rate, Number of Months in a Year), there are two terms you need to understand if you want to calculate exactly how much interest you’ll pay throughout the course of your hard money loan: per diem and proration.

- Per diem is a Latin term which translates to “per day” in English. It’s used to refer to how much interest accrues on a daily basis.

- Proration is the process of dividing or distributing something proportionally. In finance, it often refers to the allocation of a cost or benefit based on the length of time it was used. As a real estate investor you may be familiar with the term as landlords often use it to calculate partial rental payments.

The reason these two terms are important is because, although interest payments for hard money loans are typically calculated on a monthly basis, most real estate deals don’t close on the first day of the month. Lenders need a way to account for this in order to charge their clients accordingly.

Calculating Per Diem

Because most real estate deals don’t close on the first day of the month, calculating interest on a monthly basis doesn’t accurately reflect how much interest you’ll owe over the course of your loan. In order to be more accurate, hard money lenders (and you) need to know how much interest is accruing on the loan each day (aka the per diem).

To determine your loan’s per diem, you’re going to use the same formula from my previous post but you’re going to substitute the number of months in a year (12) with the number of days in a year. As an important note, most hard money lenders use a 360 day calendar. To understand why you calculate the loan payment on a daily basis, see the note at the bottom of my first post in this series.

Your formula for calculating per diem will look like this:

Loan Amount x (Annual Interest Rate / 360) = Per Diem

Example

For sake of example, let’s use the same scenario we used in my first post and say you borrow $100,000 from a hard money lender who charges an annual interest rate of 12%. To calculate your per diem you would simply plug these figures into the formula above, which would look like this:

$100,000 x (12% / 360) = $33.33

Now that you know your per diem, you’re ready to calculate your prorated interest payment for the first month of your loan term.

Calculating Your First Month’s Interest Payment

Remember, most real estate deals don’t close on the first day of the month. In order to calculate your interest payment accordingly, hard money lenders will prorate your first month’s interest payment based on the number of days between the closing date and the last day of the month. As an important note, this prorated amount will often be due at closing.

The formula to calculate your prorated interest payment for the first month of your loan will look like this:

Per Diem x (First Day of the Next Month – Closing Date) = Prorated Interest Payment

Example

As an example, let’s use the same per diem we calculated above and say you closed on (purchased) a property on January 20, 2023. Our formula to calculate your prorated interest payment would be:

$33.33 x (February 1, 2023 – January 20, 2023) = Prorated Interest Payment

The number of days between February 1, 2023 and January 20, 2023 is 12, so really your formula looks like this:

$33.33 x 12 = $400

If you count the number of days on your own, you’ll find that you count 13 days from January 20th to February 1st. However, since interest payments will be made in arrears, you’ll only want to account for January in this calculation as February 1st will be accounted for in March’s payment. When you use Excel, Feb. 1st – Jan. 20th = 12 days, which works well for this calculation.

Calculating Your Normal Monthly Interest Payment

I discussed how to calculate your normal monthly interest payment in my previous blog post. As a reminder, the formula is:

Loan Amount x (Annual Interest Rate / 12) = Monthly Interest Payment

If we plug in the figures from our example above, your formula looks like this:

$100,000 x (12% / 12) = $1,000

So, your monthly interest payment would be $1,000.

Calculating Your Last Month’s Interest Payment

In order to calculate your last month’s interest payment, you will need to consider all three of the components we’ve discussed so far in this post: (1) per diem (2) prorated interest payments and (3) normal monthly interest payments.

Here’s how it works:

Step 1: Calculate the total number of days your loan will be outstanding

To do this, simply count the number of days between your first closing date and your second closing date.

For example, if you use a hard money loan to purchase a property and close on January 20, 2023, then you sell that property and close on July 16, 2023, then the total number of days your loan is outstanding will be:

July 16, 2023 – January 20, 2023 = 177 days

Step 2: Calculate how much total interest you’ll accrue on your loan

To calculate the total interest, simply multiply your per diem by the total number of days your loan is outstanding.

We’ll use the per diem from our example above and use the total number of days outstanding that we just calculated in Step 1. If we multiply them together, we get:

$33.33 x 177 days = $5,900 total interest accrued

Step 3: Calculate how much interest you’ll pay on your loan before the final month

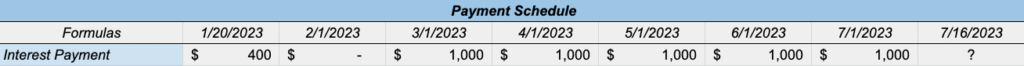

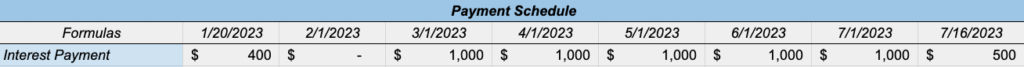

To do this, add up all of the interest payments you’ll make on your loan, including the first month and excluding the last month. The best way to demonstrate this is with a picture from a model we use at Sharper Capital Partners (below).

As you can see, you’ll pay five months of interest in the amount of $1,000 each, plus your prorated interest of $400 at closing.

So, your total interest payments before the final month of your loan will add up to $5,400.

Step 4: Calculate the difference between the total interest you’ll accrue on your loan and how much interest you’ll pay on your loan before the final month

This is the final step. Now that you know how much total interest you’ll accrue on your loan and how much you’ll pay before the final month, all you need to do to find your final month’s interest payment is calculate the difference.

In this example, your formula will be: $5,900 – $5,400 = $500

The reason there’s no payment scheduled for February is because interest payments on hard money loans are paid in arrears. So, because you pay January’s prorated interest at closing, no interest will be due until March when you’ll pay February’s full interest amount.

Takeaways

- Per diem is a Latin term which translates to “per day” in English. In the context of interest payments, it’s used to refer to how much interest accrues on a daily basis. The formula to calculate per diem on your hard money loan is: Loan Amount x (Annual Interest Rate / 360) = Per Diem

- Proration is the process of dividing or distributing something proportionally. In finance, it often refers to the allocation of a cost or benefit based on the length of time it was used.

- The formula to calculate your prorated first month’s interest payment is: Per Diem x (First Day of the Next Month – Closing Date) = Prorated Interest Payment

- The formula to calculate your normal monthly interest payment is: Loan Amount x (Annual Interest Rate / 12) = Monthly Interest Payment

- The difference between how much total interest you’ll accrue on your loan and how much interest you’ll pay before the final month is how much interest you’ll owe for the final month of your loan.

Calculating your interest payments can be a lot of work, and at Sharper Capital we provide this information for our clients so they don’t have to do it themselves. Unfortunately, not every hard money lender does the same, so it’s important to be educated and understand where the fees you’re paying actually come from.

To continue your education, sign up for the Sharper Capital Newsletter.

With your FREE subscription, you get access to our top educational resources like:

- Our 24-hour Project Approval Checklist

- Our guide on How to Analyze a Fix-and-Flip

- Our guide on How to Get No Money Down Financing

- The Pros and Cons of Using Hard Money Lenders

- Access to new releases of the Hard Money Podcast

1 thought on “How to Calculate Interest on Your Hard Money Loan (Part II)”

Pingback: 5 Hard Money Loan Fees You Should Know About