If you’re scaling your real estate business, it’s only a matter of time before you graduate from traditional financing to more creative options like a hard money loan.

Creative options cover a wide range from lines of credit to private capital.

Oftentimes, hard money is the next financing option for many investors scaling their real estate portfolio.

This could be for several reasons:

- You’re not working a W-2 and therefore no longer qualify for most traditional options.

- You’ve maxed out the number of conventional loans you can use for your buy-and-hold portfolio.

- You’ve maxed out your personal debt service coverage ratio for conventional loans.

- The conventional loan process is not quick enough for you to take advantage of time-sensitive deals.

These are just a few reasons why many clients come looking for hard money.

So, before we get into how to get a hard money loan, let’s talk briefly about what hard money is.

What is a Hard Money Loan (HML)?

A hard money loan is a loan provided by a business entity that is tied to a hard asset (e.g. Real Estate) typically for a short period of time – 12 months or less – for non-owner occupied, investment property.

In comparison to conventional bank loans, Hard Money Loans are generally:

- More expensive

- Provide faster funding

- Have fewer hoops to jump through

- Care less about borrower credit scores

- Intended for non-owner occupied, Investment property.

Hard money loans can take the form of several products such as fix and flip loans, bridge loans, transactional funding, and pretty much anything the hard money loan operator sees as a necessary product in the market.

So How Can You Get A Hard Money Loan?

The process for procuring this type of loan can be broken down into the following steps:

- Inquiry => Soft Loan Quote

- Comparable Analysis => Hard Loan Quote

- Underwriting => Final Loan Quote

- File Prep = > Closing

So let’s get into what you can expect in each step.

Step 1: Inquiry => Soft Loan Quote

Pro Tip: Before you ask your lender for a quote, state whether the property is under contract.

The first step is to contact a hard money lender and provide them with your project details.

Things that hard money lenders are going to want to know about your PROJECT:

- Is the property under contract?

- When is the scheduled closing date?

- What type of property is it? (e.g. Single family, multi-family, apartment, etc.)

- What kind of loan are you looking for? (e.g. fix and flip, bridge loan, etc.)

- What is your purchase price for the property?

- How much work does the property need? (Rehab Costs)

- How much is the property worth after rehab is complete? (After Repair Value)

- What is the exit strategy? (Sell or refinance)

- What area is this property in? (E.g. West Chester, OH)

Things that hard money lenders want to know about YOU:

- How many properties have you bought and sold in the last two years?

- What is your credit score?

- What are your available liquid assets for this project?

Based upon the information provided to the above questions will determine whether a lender moves forward with you and your project.

At the end of this inquiry, the lender should have a response like this:

“Based upon what you are telling me, we could loan you a total of $200,000 with $150,000 going toward the purchase price and $50,000 going toward rehab costs. We estimate that you will need to bring $50,000.00 to closing. We are lending out at 2 points and 12% APR so your monthly payment would be $2,000. Does that work for you?”

If it works for you, then your lender will respond with something like this:

“The next step in my underwriting is to pull some comps for your property. Could you tell me the address real quick?”

You provide the address.

“Okay great. I’ll check out properties in that area and give you a callback.”

Step 2: Comparable Analysis => Hard Loan Quote

At this point, your lender is going to pull comps just like a real estate agent would.

If there is anything odd or obscure about the property, it’s best to get that out in the open to maintain your credibility as a real estate investor.

Remember, transparency leads to trust.

After your lender gets their own idea of the property’s value, they will give you a call back to discuss their findings.

If both of you came to the same conclusion on the after-repair value (ARV), then you’ll move on to step three.

In the event, your lender comes to a lower ARV than you, then they will adjust the loan amount they quoted you.

In some cases, lenders may choose not to lend on the property altogether.

Either way, your lender is unlikely to renegotiate the ARV, so it’s best to either accept the new loan amount or move on to a different lender.

Step 3: Underwriting => Final Offer

Step three is where you are going to arrive at your final loan quote.

Your lender is going to typically charge some sort of appraisal fee to go out and view the property or hire someone to do so in their place.

We charge a $400 appraisal fee and we can usually see the property in 72 hours or less.

If possible, it’s great to meet the lender at the property to build additional trust.

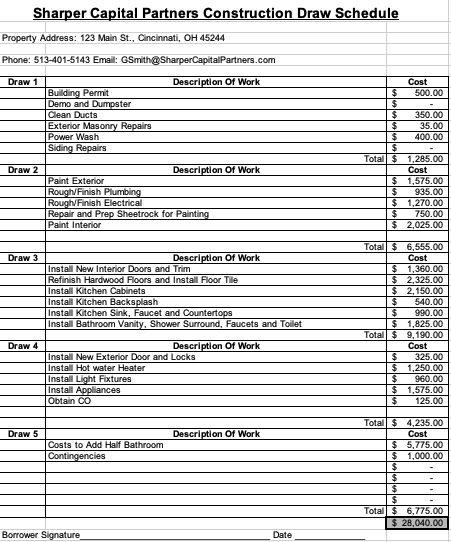

Before walking the property, your lender is going to want to look at your detailed scope of work and draw schedule.

It will look something like this:

During the walkthrough, the lender is going to check for the following:

- Any major repairs not noted in the scope of work

- Other major areas of risk like roof and foundation.

- Any oddities with the property that make it different from comps in the area (e.g. Railroad tracks in the backyard).

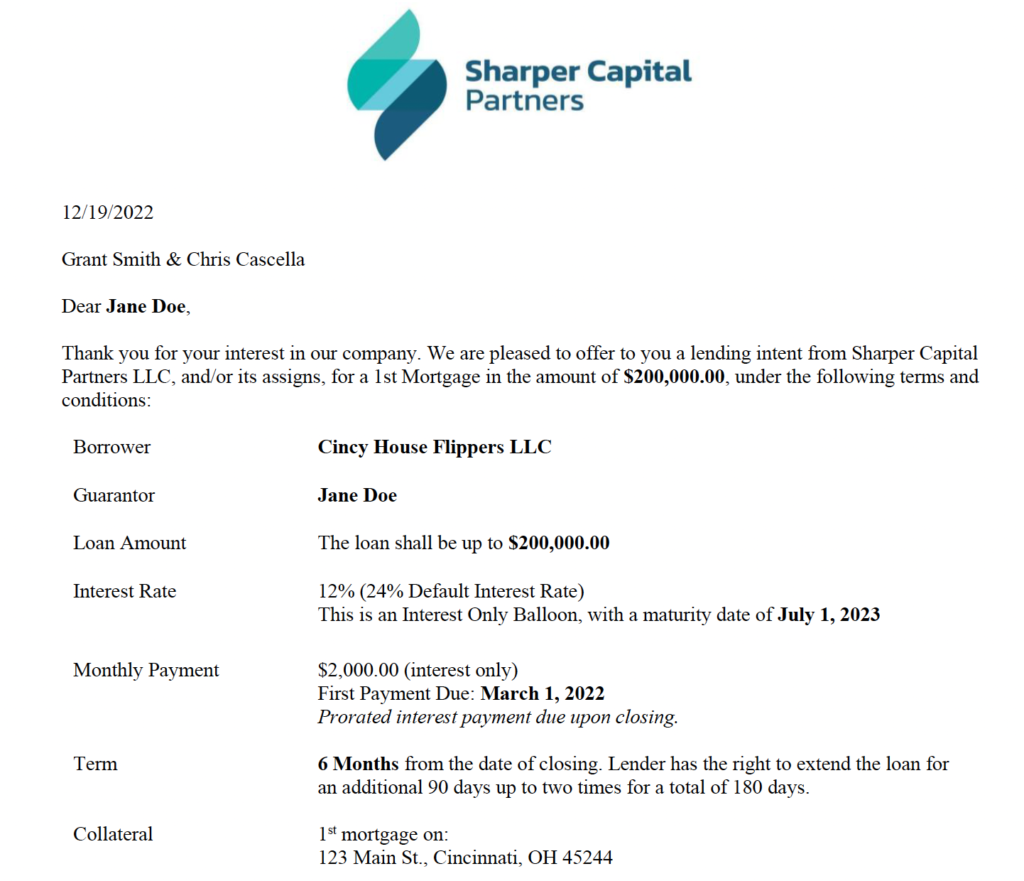

If the scope of work and ARV of the property remains the same, your lender will draft a lending intent and ask for your signature with the final loan quote.

The lending intent explains the terms of the loan in a written format and is not a contractual obligation.

It will look something like this:

If the scope of work increases, or the ARV is reduced, your loan quote may change from the quote in your previous step. At this point, you can accept the new loan or seek other options.

Assuming you’re moving forward with the loan, it’s time to start building your file for closing.

Step 4: File Prep => Closing

Once the lender has received a signed lending intent and a finalized draw schedule, they will begin collecting documents to build the rest of your file.

This will typically include:

- State or Federal ID

- Credit Check

- Asset Statements (e.g. Bank Statements, Investment Account Statements, etc.)

- Business Entity Documents (Articles of Formation & Operation Agreement)

- Contract for Purchase

From here, the lender will pass this information on to their transactional attorney who will work in conjunction with your title company.

The final preparation for closing may require a survey and will likely require various forms of insurance to be obtained either from the title company or by you as the borrower prior to closing such as:

- Hazard Insurance

- Tenant Insurance

- Builders Risk Insurance

Once all requirements by the title company and lender are met, all parties will wire funds and documents will be recorded.

Hard Money Loan Approval Takeaways

While the steps in the process seem cumbersome, an experienced and professional hard money lender will have organized processes and a dedicated team to take you from inquiry to property close in a matter of days not weeks.

Take note that three of the four steps above have to do with one thing: underwriting.

The more diligent and well-documented you are in your underwriting will likely determine how accurate you both are in coming to the same ARV on the property.

Although we touched a lot on the block and tackle of getting a hard money loan, it’s important to remember that your character of you as a borrower is just as important as the collateral that they lend on.

Take time to build a relationship with your lender because that could ultimately be the deciding factor on whether your property gets funded.

So that’s how you go from project inquiry to project close with a hard money loan.

Want to learn more about hard money loans and creative finance? Check out our latest Youtube content!

1 thought on “How to Get A Hard Money Loan”

Thanks!